Pohnpei businesses adopt RMS for faster, paperless tax returns

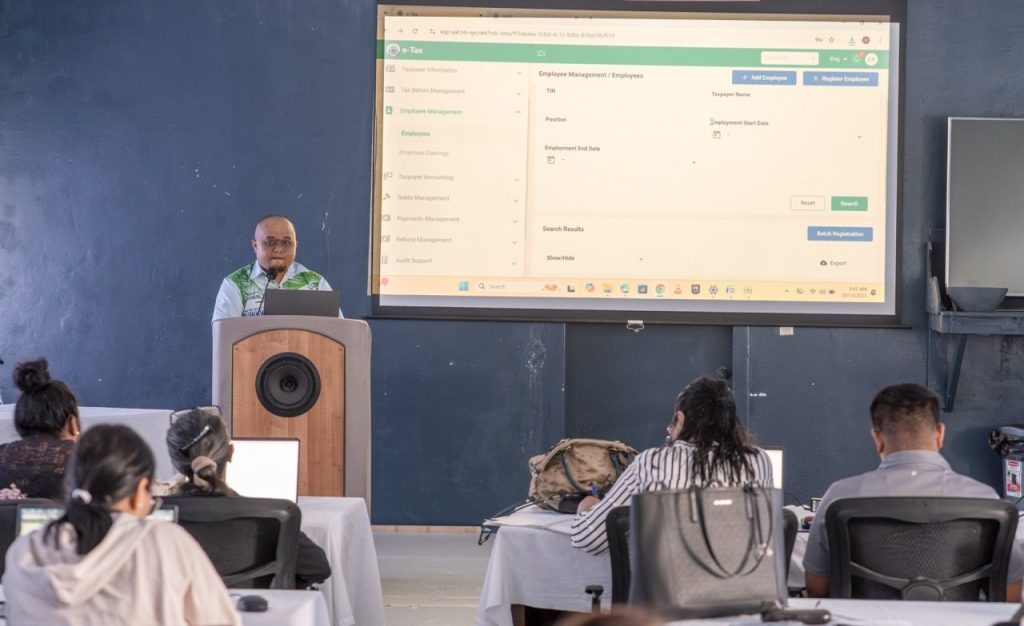

Palikir, Pohnpei — October 14, 2025. The Department of Finance & Administration (DoFA), Customs & Tax Administration (CTA) delivered a three-day, hands-on workshop to help employers and small businesses learn how to file their returns using the new Revenue Management System (RMS). Sessions ran October 14–16, 2025 (9:00am–4:00pm) at the Pohnpei State Hospital Conference Room (Director’s Building, First Floor), with participants rotating through identical training days.

Designed for staff and small businesses who handle payroll and tax filing, the workshop walked participants through user management (assignees and roles), employee withholding, Gross Receipts Tax (GRT), return verification and submission, and concluded with one-on-one assistance for those ready to submit their Q3 2025 returns on the spot. Attendees brought laptops and supporting documents to practice live in the RMS.

Randy Sue, Assistant Secretary, FSM Customs & Tax Administration (CTA), said the training is part of CTA’s commitment to make filing faster and fairer for everyone:

“RMS is a practical upgrade that saves people time. You can register, file, pay, and see your records online—at your convenience. These workshops are about building confidence: showing taxpayers exactly what to click, how to verify, and how to submit correctly the first time. We’re pairing the new system with in-person outreach so businesses of every size can move from paper to digital without stress. Our aim is simple—less queueing, fewer errors, and better service.”

Citizens’ experience at the workshop

Parleene H. Tom, a local shop administrator, said the practical format helped her get set up and confident:

“It’s a very friendly system. I received my temporary username and password, logged in, and could tell it’s simple to use. I’m busy during the day, so this will let me submit my tax at night from home.”

Jessica Sicra, who runs a small mom-and-pop store with four employees, said the training clarified what small businesses need to go digital:

“We’ve always filed on time to avoid penalties. We still do everything manual and don’t use laptops—but now I know exactly what I need to get started.”

For larger employers, the move to RMS means fewer paper processes. Allston Abraham of an energy company welcomed the shift and credited CTA’s outreach with getting his team over the line:

“Going paperless will help us. The presentation was engaging and very useful. CTA actually visited our office two weeks ago, and that was the trigger—we came to the workshop, logged in together, and now we feel comfortable using the system to file. It makes the whole process clearer and quicker.”

Why this matters

Through RMS, taxpayers can register, file, pay, and view their own records online, reducing queues and routine trips while improving accuracy and compliance. The training complements CTA’s phased roll-out of online services and supports a smoother filing period for both small enterprises and larger employers across FSM.

Media contacts

Randy Sue, Assistant Secretary, FSM Customs & Tax Administration — randy.sue@dofa.gov.fm | [691-320-2826 ext. 105]

Alvaro Hoyos Ramos, Communications Specialist, CIU/DoFA — alvaro.hoyos@dofa.gov.fm

About CTA (Customs & Tax Administration, DoFA)

The Customs & Tax Administration leads revenue administration for the Federated States of Micronesia and is modernizing services through the Revenue Management System to make filing more convenient for taxpayers and more efficient for the government.