PALIKIR, Pohnpei — December 23, 2025 — The National Tax Reform Task Force (NTRTF) has completed a full round of public consultations across the four states, an important step in the FSM’s work to strengthen and modernize the tax system.

Led by Honorable Aren B. Palik, Vice President of the FSM, the Task Force met with leaders and communities in Kosrae, Chuuk, Pohnpei, and Yap. Consultations brought together state and traditional leadership, community members, and representatives from both the public and private sectors—creating opportunities for open discussion, questions, and practical recommendations on tax reform and how the FSM can strengthen domestic revenue in ways that work for our people.

Across the sessions, several themes emerged clearly: the need for strong public awareness and communication, clarity on how any changes would be implemented, what the impacts could be for our citizens, and how reform proposals would be consistently implemented at the state-level. The Task Force also clarified that a proposed Net Profits Tax (NPT) and Value-Added Tax (VAT) would replace a number of existing taxes, and stressed that improved revenue collection is ultimately about the Government’s ability to fund core priorities—climate action, healthcare, infrastructure, and social services.

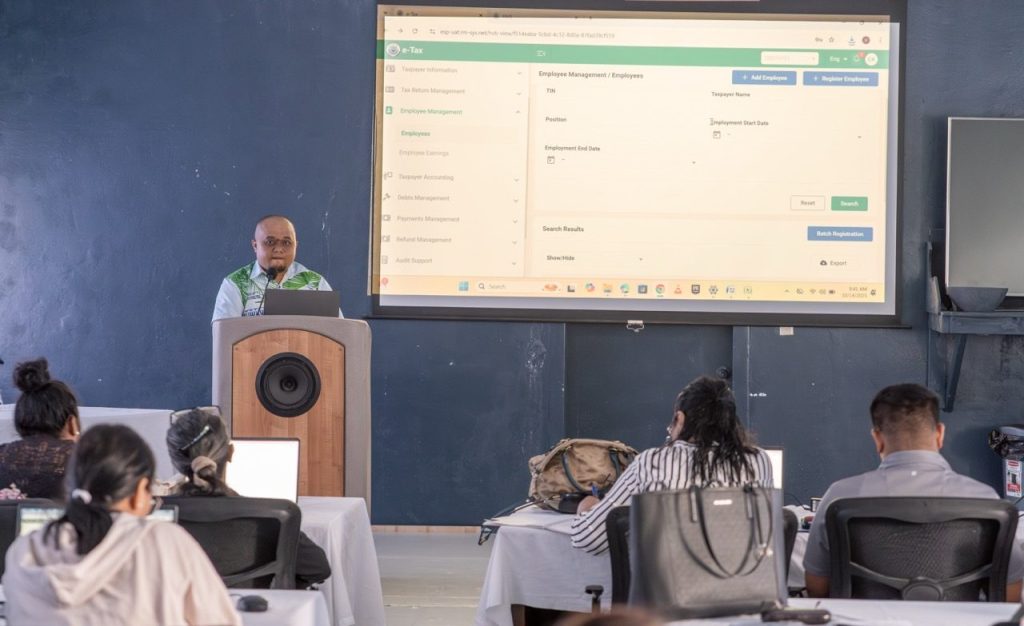

Secretary of Finance and Administration, Honorable Rose N. Nakanaga, emphasized the link between service delivery and stronger revenue administration, noting that “the FSM’s ability to generate sufficient tax revenue is largely dependent on a modern tax administration.”

From DoFA’s perspective, the message was also about preparedness: reforms work best when institutions, systems, and the public are ready. Assistant Secretary of Finance and Administration, Mr. Randy Sue, highlighted the importance of keeping the public informed as options are considered, and pointed to the Government’s focus on “promoting the introduction of modern and efficient taxes into the FSM (tax reform).”

The consultations reinforced the value of coordination between the National Government, State Governments, and the private sector so the country can move forward with shared economic and development goals. Leaders in each state voiced support for reforms that are fair and, in the nation’s, long-term interest, while also calling for continued dialogue and strong public education before any major changes are introduced.

The Task Force thanked state governments, leaders, and participants for the strong engagement throughout the tour. Feedback from the consultations will be reviewed and used to shape final recommendations aimed at a tax system that is fair, efficient, and sustainable, and consistent with the FSM’s constitutional framework.

DoFA will share further updates as the review continues.

About the RMS and the PFM Project

The Revenue Management System was developed under the Public Financial Management Project, a national initiative supported by the World Bank. The project aims to improve budget execution, public procurement, and domestic revenue mobilization. With the launch of the RMS, the FSM takes a significant step toward building a more accountable, transparent, and citizen-focused public finance system.

For further information, please contact:

FSM Department of Finance & Administration

Mr. Randy Sue, Assistant Secretary, FSM Customs & Tax Administration

Email: randy.sue@dofa.gov.fm

Web: https://dofa.gov.fm/customs-and-tax-administration/

FSM Department of Finance & Administration

Mr. Alvaro Hoyos, Communication Specialist, CIU.

Email: alvaro.hoyos@dofa@gov.fm

Web: https://dofa.gov.fm